Last year was a busy time in the tequila world, and we expect the frenzy to keep rolling into 2020 and beyond. But before we get too far ahead of ourselves with some predictions for the year ahead, let’s take a look back at the trends we saw over the last year.

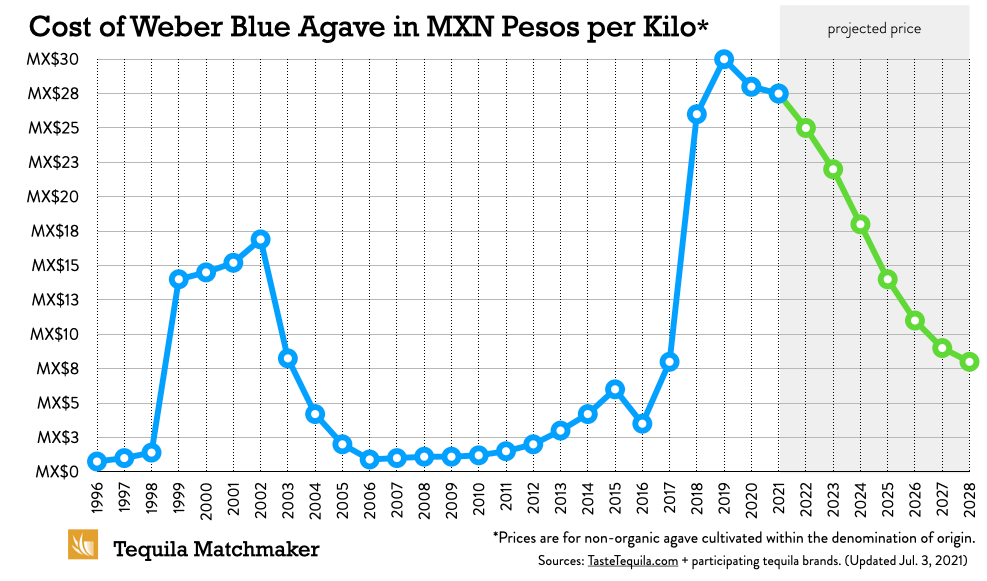

1) Agave Prices Break Records

After hitting $30 pesos/kilo at the end of 2019, agave prices have finally started to come down. Based on our survey of agave buyers and sellers, we show that the average market price of agave is now $27 pesos/kilo and should be below $24 pesos/kilo by this time next year.

The past several years have been a rough ride for many brands, with some even stopping production until prices return to normal; Others resorted to buying cheaper diffuser-made juice from other distilleries.

The crisis has been bad for the industry for more than just the bottom line. The overall quality of tequila being produced took a hit because many producers had to rely on underaged agave.

Assuming we don’t have a devastatingly cold winter, the downward pricing trend should continue, and life in the tequila industry could return to normal within a few years.

2) The Clooney Effect – New Players Rush In

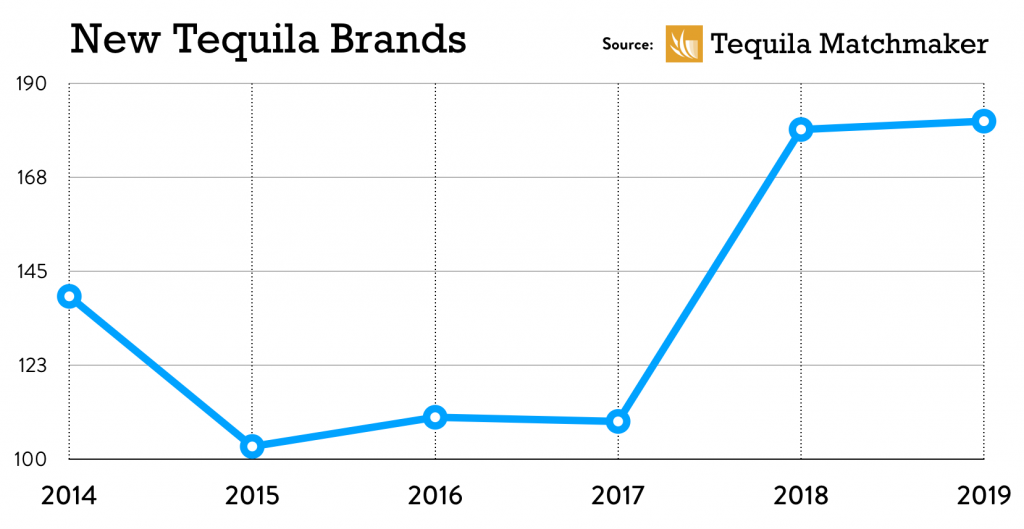

Despite the record-breaking price for agave, new brands keep rushing into the market. We added 181 new brands to our database in 2019, and we know of quite a few that are slated to launch in 2020. We’re not sure exactly why this is–-perhaps these new players are high on the possibility that they too will sell their brand for nearly $1 billion, just like George Clooney’s Casamigos. Of course, Clooney is a big name with big reach, so these new brands are facing a much higher barrier to entry.

One new brand that’s getting a lot of attention is “Teremana” (NOM 1613), yet another celebrity brand as Duane “The Rock” Johnson throws his name into the ring. His tequila is scheduled for a public launch in March, and it’s being made at Productos Finos de Agave (NOM 1416) in Jesus Maria, Jalisco.

Basketball legend Michael Jordan also caught air in 2019 with the release of his own brand, “Cincoro,” which is being made at Destiladora del Valle de Tequila (NOM 1438).

3) Efficiency Deficiency

While high agave prices led some producers to install super efficient diffusers to cut costs and speed up production, our blind tastings of these products over the last year have made tasters’ opinions clear – products that use diffusers to separate the fibers from raw agave just don’t make the cut. (The diffuser as a tool isn’t in itself bad–-like anything, it depends on how you use it.) But when a diffuser is used in this way, the tequilas they produced scored the lowest on average in 21 blind tastings by 410 bartenders and aficionados compared to traditionally-made products.

Click to enlarge these charts, which show the average scores based on production type from all of our blind tasting events in 2019:

4) Artisanal Amp Up

The fact that diffuser products do not rate as high is probably a big part of the reason that some select brands have decided to return to old-school methods, such as using a tahona (a large stone wheel) to crush agaves, and a brick oven to cook them, rather than an autoclave.

This is the case at Cascahuín (NOM 1123), which installed a tahona in late 2018, to supplement its roller mill production.

“Our philosophy is to show consumers that tequila changes batch by batch since the raw material (agave) changes,” says Salvador Rosales Trejo, a 3rd generation tequilero, who runs Tequila Cascahuín, along with his father Salvador Rosales, Sr. “So, the way to demonstrate it in a simpler or clearer way is by making changes in the production processes.”

As for the fact that using a tahona is less efficient, and thus more costly than more modern methods, Cascahuín thinks it’s worth it.

“We believe that there are different markets and therefore there are consumers who are looking for, and wanting to try, the more intense and complex flavors that the blue agave brings (when using a tahona).”

Cascahuín now showcases its tahona juice in the highly-rated Cascahuín Tahona Blanco product, which is 100% stone crushed. Rosales believes the tahona process gives it more intense agave flavors and aromas, as well as mineral and brine.

The newly installed tahona at the Cascahuín distillery.

And over at Arette, one of their autoclaves was removed so that they could install a brick oven. The oven was completed, and it was used to cook their first batch of agave, in June 2019.

“We wanted to see how big of a difference a brick oven would have compared to an autoclave,” said Eduardo Orendain, whose family owns Arette Tequila. “We found some big differences.”

“We noticed more floral, creamy, and mineral notes with a softer profile in the brick oven batches, while the autoclave has more peppery, green, and herbal notes,” he said.

Tres Agaves, a tequila brand that has been in the market for a decade, is in the process of building their own distillery, which also has a tahona installed.

We’ve received reports that distilleries Tres Mujeres (NOM 1466); Cava de Oro (NOM 1477), and Don Valente (NOM 1450) have either installed, or are in the process of installing, tahonas.

We’ve even heard that the well-known diffuser distillery, Leyros (NOM 1489) (maker of Casa Dragones, amid others), has plans to install a tahona next year, although representatives didn’t return our queries on the subject.

The newly installed brick oven at the Arette distillery.

PREDICTIONS

Agave Prices Stay High

Although agave prices are coming down from their peak of about 30 pesos a kilo in the second half of 2019, they will get nowhere near the single-digit prices we’ve seen in previous years. Prices are currently at around 27 pesos/kilo and we expect them to fall to about 24 pesos/kilo by the end of the year.

Other Agaves Used to Make “Agave Spirits”

As the price of blue agave has mounted, some tequila brands have started playing with different types of agave. We predict that this trend will continue, as producers look for alternatives in raw materials, and consumers look for new flavor profiles.

In 2017, Calle 23 released its “Criollo” – a higher proof tequila using a more squat (with a higher sugar content) variant of blue agave, called “criollo” by locals. This is still technically a blue agave, but renders more intense floral, earthy, and minty aromas and flavors.

Meanwhile, El Caballito Cerrero, always a rebel brand, decided to produce a tequila using an agave that falls outside of the strict rules calling for blue weber plants only in the production of tequila. In 2018, Caballito Cerrero released an Angustifolia “Chato” agave spirit, to much praise by tequila aficionados.

Some believe that this successful move will open the door to more agave distillates going forward.

More Distilleries

High agave prices are having another interesting result — some agaveros, who are loaded with profit right now, are deciding to invest it into a distillery of their own. Partly because this is a way for them to generate much needed tax deductions, and partly because they know what’s only a few years away: super low agave prices.

Their logic: When agave prices drop, they’ll be able to switch gears and cover expenses by making tequila with their own agave instead of selling it at a loss.

We have heard of several new distilleries in various stages of construction, including the agave-growing partners of the Tequila Las Americas distillery (NOM 1480), who are set to open their second distillery.

Agave grower and respected master distiller Enrique Fonseca, the owner of the La Tequileña distillery (NOM 1146) in Tequila, is nearing completion of a second distillery located in Atotonilco El Alto.

And Carlos Camarena, master distiller of El Tesoro de Don Felipe and Tequila Ocho, is building his own distillery in Arandas. Under the current plan, upon completion Tequila Ocho will be produced at this new distillery.

Several tequila brands are also in the process of building their own distilleries, including Tres Agaves; Clase Azul; Tequila Tromba; and Loco.

Diageo, the new owners of Casamigos, built a giant distillery directly (NOM 1609) across the street from Patrón in Atotonilco el Alto. Meanwhile, Patrón is in the process of building another distillery just behind their current facility.

More Brands

As if there weren’t enough already, more are coming. Lots more. The high price of agave has not slowed the rate of new brands entering the market, and that will continue for years into the future. We added an average of 15 new tequila brands to our database each month in 2019.

It’s not just for celebrities, either. We are contacted several times each week by people in the process of starting a new brand, and we fully expect this to remain unchanged.

(Our advice to them all? Don’t do it!)

Demand for More Transparency

“Additive-free” tequilas and “non-diffuser” brands? Get ready, because we are already seeing consumers’ demand for more transparency in the tequila world leading to some brands including production details on their labels. This is coming from the brand marketing side, of course, and not the CRT (Tequila Regulatory Council).

Still, as consumers become more savvy about how and where their favorite tequilas are made, the need to address questions about additives, production processes, and quality relative to price, will become more urgent.

The Great Divide

More and more people outside of the hardcore aficionado community will start to see the tequila industry in two distinct groups: More expensive, traditionally-produced, small-batch products; and mass-produced, large scale, cheaper tequilas.

There is plenty of room for both of these segments to grow in the years to come.

As more craft brands feature production details on their labels, and take a more transparent and accountable approach to their marketing, the average consumer will begin to take notice.

We know this because our list of verified additive-free tequilas, and our story about additives in tequila together generated more page views, search results, and follow-up emails in 2019 than any other piece of content on our sites.

So, that’s what we see on the forefront of tequila – what are your thoughts? Salud, and happy new year!